Introduction to financial ratios

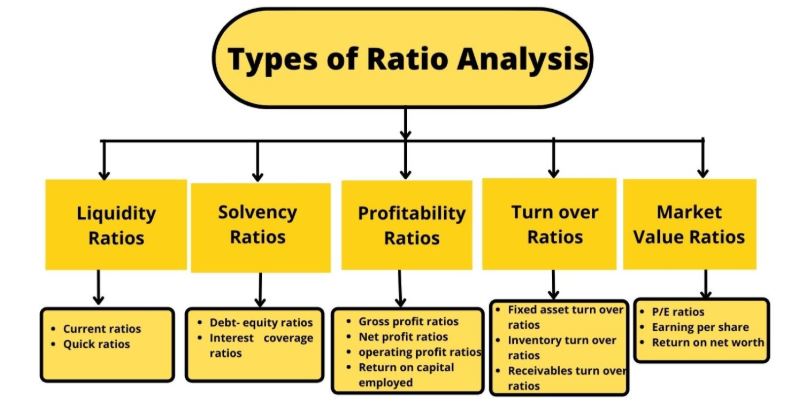

Financial ratios are useful metrics that help evaluate a company’s financial condition and the business’s performance. Generally, indicates a valuable tool for investors who want to access the history of companies’ financial statements and the overall performance of the business. The ratios are useful for calculating balance sheets, cash flow statements, and income statements. The ratios promote and provide profitability, market value, and liquidity ratios through the calculation (Bloomenthal, 2024). The signals are indicators of strength or loss for a business. With the analysis of ratios, the business owners gain a deeper understanding of how the company is operating and how well the resources are being managed (Harinurdin, 2022). Additionally, with the comparison of ratios, assesses how well the company is doing compared to its competitors.

Essential Financial Ratios

Liquidity ratios

Generally, liquidity ratios are important for measuring the ability of the company to meet its short-term applications. Moreover, the ratios assesses the ability of resources to pay the short-term debt. The current ratio indicates how the company will cover its capability in its short-term debt. The quick ratio indicates how quickly the liquidity of a company would turn into cash.

Profitability ratio

In fact, profitability ratios indicate how much a company is benefiting through expenses and sales. Subsequently, increasing the net profit margin indicates how much total revenue it is generating (Elmerraji, 2025). Accordingly, the return on assets indicates how much net income is generated by the company.

Efficiency ratio

The efficiency ratio indicates the generation of revenue with the help of both assets and liabilities. The asset turnover ratio specifically indicates how much the company is utilizing its assets efficiently and how much revenue it is generating (Riverstonetrainingsg, 2025). The inventory turnover ratio indicates strong sales and poor performance of sales.

Leverage ratios

Generally, the leverage ratio indicates how the company is dependent on the borrowed funds. The ratio assesses the long-term ability of the company. The debt-to-equity ratio indicates the total liabilities to the equity. The financial leverage ratio indicates how much earnings and revenue are generated due to debt financing.

Financial Ratios

Importance of financial ratios in businesses

Evaluation of financial stability

The ratios assess investors whether the company’s financial status is in good condition or not. With the analysis of financial status, the businesses determine their stability. Moreover, the analysis helps in making decisions regarding investing money in a business.

Monitoring the performance of business

Basically, there is an open comparison of past performance and competitors with the current ratios of the company. Therefore, monitoring helps in tracking the progress and making advanced predictions regarding the future of the company.

Identification of strengths and weaknesses

Financial ratios help in making a strong connection with the operation of the company. Both strong abilities and weak points are evaluated in the performance of business. For example, the ratios reveals if the business is at risk or in profit margins.

Evaluating financial condition

The financial ratios help in evaluating the condition of business by examining the financial statements of business. Especially, the ratios supports investors in making well-informed decisions and highlights where the improvements need to be achieved (C, 2023). Moreover, measures performance by identifying patterns and implementing necessary changes to the approach.

Advantages of financial ratios

Financial health and performance

One of the major advantages of financial ratios is an analysis of the performance of the company. The issues are involved related to ratios elements such as liquidity, profitability, solvency, and operational efficiency in which businesses operate. So, the enhancement in regular monitoring and making effective decisions helps the investors spot the financial problem at an early stage.

Evaluating debt repayment capacity

Several ratios indicate long-term financial specifications. With the analysis of various ratios, it operates towards good financial performance without any financial risk. Also, the system promotes planning for the future.

Benchmarking against the competitors

The benchmarking supports stakeholders to make an analysis and determine the performance. The investors particularly make use of the financial ratios to enhance the investment opportunity (Yehiel, 2024). Moreover, benchmarking is helpful to consider and make stable investment options in the various businesses.

Support strategic decision-making

The data which is achieved from financial ratio analysis supports the company leadership to evaluate the performance and make effective decisions. With the understanding of financial ratios, management makes effective decisions towards the company’s goals.

Anticipating future trends

Financial analysis is not only in the case of analysis of current trends but also provides and promotes future trends. The patterns reveal both historical analysis and future performance of the company. Also, provides predictive insights to change according to the market positions.

Limitations

Inaccuracy in forecasting

Sometimes, using the past analysis of financial data becomes difficult because of unexpected changes and internal variations. The changes becomes complex for predicting the future outcome.

Expertise knowledge

To figure out the ratio analysis, there should be a solid understanding of financial analysis and deeper concepts of accounting. Without the basic knowledge, it consequently lead to many incorrect decisions and conclusions.

Lack of standardization across various industries

However, various industries follow different methods. The comparison of financial ratios sometimes mislead. So, there should be standardized norms involved in business.

Limitations of financial ratios

Conclusion

The financial ratios indicate a major role in the business in making financial decisions. Various ratios help in assessing the business performance and attaining long-term stability. For investors, the ratios are the major tools to evaluate the business and make an analysis of future trends. However, it is important to use the financial ratios in all aspects. Additionally, has various benefits in promoting communication between various business stakeholders and companies to make investments in various sectors. To conclude, these are not just trends but make the businesses more effective with effective decision-making. After all, the businesses improve performance with effective decisions.

References

Bloomenthal, A. (2024, Jul 26). Financial Ratio Analysis: Definition, Types, Examples, and How to Use. Retrieved from Investopedia: https://www.investopedia.com/terms/r/ratioanalysis.asp

C, M. (2023, Mar 29). The Importance of Financial Ratios. Retrieved from Linkedin: https://www.linkedin.com/pulse/importance-financial-ratios-miguel-c

Elmerraji, J. (2025, Feb 21). Guide to Financial Ratios. Retrieved from Investopedia: https://www.investopedia.com/articles/stocks/06/ratios.asp

Harinurdin, E. (2022). The Influence of Financial Ratio and Company Reputation on Company Stock Prices Financial Sector †. Proceedings, 83(01), 47. Retrieved from https://www.mdpi.com/2504-3900/83/1/47

Riverstonetrainingsg. (2025, May 24). Smart Financial Ratios: Leverage & Business Growth. Retrieved from Medium: https://medium.com/@riverstonetrainingsg/smart-financial-ratios-leverage-business-growth-9a3506bf102a

Yehiel, O. (2024, Feb 04). Why Financial Ratios Are Still the Best Indicator of a Healthy Business Model. Retrieved from Datarails: https://www.datarails.com/why-financial-ratios-best-indicator/

Keywords

Investment decisions, strategic planning, income statements, Deb-to-equity, financial performance

Relevant Articles

Strategic Decision Making: Tools and Technique for Managers

Role of Enterprise Resource Planning (ERP) Systems in Driving Business Efficiency and Growth